In Q224, inflation continued trending down prompting the start of the easing cycle by G10 central banks. The global economy surprised positively as growth has been robust so far. Financial market valuations have risen globally.

Francesco Mandalà, Chief Investment Officer

Patrick Quensel, Head Investment Advisory

Quarterly Review: Macro and Markets

Financial market started Q224 on a weak note.

In April, concerns about inflation heightened, particularly after the US CPI report showed that core CPI had risen by +0.4% in March for the third consecutive month.

Geopolitical tensions increased in the Middle East when Iran launched a drone and missile attack on Israel on April 13, marking the first direct attack on Israel from Iran. Reports about a potential attack had already led to an early equity selloff and, on April 12, Brent crude oil prices hit USD 92 per barrel. However, as tensions eased and a further escalation did not occur, oil prices declined.

In May, markets put in a strong performance as the S&P 500 and the STOXX 600 climbed to new records, partially supported by Fed Chair Powell's dovish comments that pushed back concerns that monetary policy could tighten further. US inflation showed signs of easing, with core CPI slowing to +0.3% in April.

As the geopolitical situation eased, Brent crude oil prices fell again after gains in the first four months of the year. By June, rate cuts were increasingly in focus. The ECB delivered its first rate cut since the pandemic, lowering the deposit rate by 25bps to 3.75% and the Bank of Canada delivered its first rate cut.

Overall, four of the G10 central banks initiated the easing cycle. In the US, the Fed did not cut rates in Q2, but the May inflation figures showed the slowest monthly core CPI since August 2021. Slowing US inflation helped cementing expectations that rate cuts were still on the horizon and, at the June FOMC meeting, the median dot still pointed to one rate cut by the end of the year.

Political developments were also back in focus as the European Parliamentary elections took place in early June. In France, President Macron's announcement of snap elections led to a notable selloff of French assets. The Franco-German 10yr spread widened by +29bps in the week after the election announcement, the biggest weekly spread widening since the sovereign debt crisis in 2011, and the CAC40 registered its worst weekly performance since March 2022, closing Q224 at -6.6%.

Another theme of Q224 was the ongoing divergence between mega cap stocks and the rest. The Magnificent 7 were up by +16.9% in Q224 - Nvidia alone +36.7% - which helped the S&P 500 to post a third consecutive quarterly gain of +4.3%. However, the equal-weighted S&P 500 fell by -2.6% and the small-cap Russell 2000 was down -3.3%. In Europe, the STOXX 600 was only up +1.6%, and in Japan, the Nikkei was down -1.90%, after a very strong gain in Q124 of +21.6%.

From an investment style or factor perspective, in the US, Growth continued to outperform registering +9.4% in Q224, followed by Quality and Momentum at +5.3% and +4.5%, respectively. In Europe, the best performing factors were Quality and Momentum at +2.7% and +2.4%, respectively.

For fixed income investors, Q224 was about assessing how and when the easing cycle by major central banks would start. As a result, yields lacked direction and moved within a range: the US 10y Treasury yield at the end of June was at 4.39% (+19bps in Q224) and the 2y Treasury yield was at 4.75% (+13bps in Q224).

Among corporate bonds, European High Yield was the best performing asset (+1.4%), followed by US High Yield (+0.7%).

Outlook

Our baseline scenario has not changed since January 2024. We still expect a recession in the US, decelerating inflation, the Fed to cut rates three times and quantitative tightening (QT) to continue in 2024. In the Euro area, we expect a recession, lower inflation, the ECB to cut rates twice and QT to continue in 2024.

One of the key questions is how the US election might affect financial markets. Based on historical data, there is no clear correlation between presidential elections and stock markets performance. However, research shows that a significant pattern of higher stock market volatility is likely to emerge in the months ahead, representing an opportunity to hedge portfolios.

It is reasonable to reduce the equity allocation and move more into defensive areas of the equity market. From a sector perspective, Health Care still offers such attributes and due to the GLP-1 trend, the sector incorporates a growth tilt as well.

Similarly, when looking at factors, Quality has some of the most favorable traits due to its exposure to companies with strong fundamentals and topline growth, and thus, should better withstand any potential economic weakness. In this regard, we also consider AI to continue to be one of the key themes driving stock performance. However, while investor interest in the AI revolution is not new, we believe downstream investment opportunities in utilities, renewable generation and industrials, whose investment and products are needed to support this growth, represent an underappreciated opportunity.

In fixed income, long-duration high quality bonds, high yield and EM local bonds provide an attractive risk-reward profile, when compared to the low equity risk premium.

From a regional perspective, we remain cautious on Emerging Markets in general due to the rising risk of a re-emerging trade war and prefer a very selective approach. Among others, we still consider India as one of the best EM market plays thanks to its demographic trends, above average economic growth and limited trade links to the US.

Performance and current positioning

As Q224 ended, we reflect on the investment decisions and performance of our mandates across the key economic and markets events of the past quarter. Despite economic uncertainty, central banks' restrictive policies, continuation of the Russia-Ukraine conflict, the aggravation of the Israel-Hamas war and, on the positive side, supported by the rise of generative AI, markets generated very healthy returns. Overall, we generated good absolute and risk-adjusted returns for our clients in Q224, whilst we learnt some investment lessons from the big surprises to our expectations. In April, we rotated the equity exposure from the US Low Volatility factor into the European Quality factor by 5% on average on the basis of our market signals and macro views. The current asset allocation (see Chart 1) reflects our 'risk-first' principle, in that we still remain broadly cautious across the mandates' strategies (conservative, balanced, dynamic). From a macroeconomic perspective, we still believe that central banks will pivot in 2024. Our long-term forecasts for the Fed funds rates is that they will fluctuate within the 3.0% to 5.0% range for the next decade.

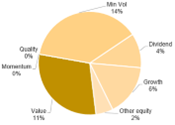

We stay cautious on developed market and EM equities, in general preferring value (relatively cheap assets), minimum volatility (safer assets), growth and high dividend companies as shown in Chart 1. In fixed income, we increased duration and high quality credit exposure in Q423, which contributed to the year-to-date performance. We are also invested in short duration high yield and hold a positive view on EM local bonds. We maintain an allocation to gold and commodities, which strongly contributed to performance in Q124. We closed the China equity position early during Q223 avoiding the drawdown experienced by the Chinese equity markets and we still maintain that view.

Chart 1: GIO Balanced portfolio's asset allocation.

As an illustration of the successful implementation of our investment approach, Chart 2 shows the performance of the portfolio Global Investment Opportunities GIO Balanced in CHF as at June 2024, since its inception in July 2021, versus the 713 portfolios monitored by the company Performance Watcher.

Our portfolios strongly outperformed in risk-adjusted terms most of the 713 portfolios and the index (PW mid Risk CHF) assigned by Performance Watcher. Chart 2 also shows a black dotted line computed by Performance Watcher, which corresponds to the slope of the Sharpe ratio of the benchmark index.

Chart 2: GIO Balanced CHF risk/return profile vs. 713 peers[1].

[1] Source: Performance Watcher for the period 1/7/2021 to 30/6/2024. Performance shown for illustrative purposes only.

Insights into MBaer Factor-Based Asset Allocation

The traditional approach to portfolio construction consists of investments in market-cap-weighted passive and active funds.

Factor investing is somehow between the passive and active investing techniques, targeting specific return drivers (factors) and market betas. The factor strategies typically follow a systematic, rule-based approach and are implemented with low-cost investment vehicles. The factor investment approach is widespread among institutional investors, including family offices, pension funds, insurance companies and Sovereign Wealth Funds (SWFs). As a prominent example, the Norwegian Pension Fund, one of the largest SWFs in the world, pursues a top-down factor investing approach, following the advice of three finance professors - Andrew Ang, William N. Goetzmann and Stephen M. Schaefer. Based on our research, we construct and manage portfolios considering various economic scenarios' impact on the asset classes' returns and risk profiles.

Chart 3 shows risk-adjusted returns (Sharpe ratios) on various asset classes and factors across several macro environments spanning almost a half-century, from 1972 to 2018.

The results in Chart 3 point to the cyclical behavior of traditional asset classes and, second, to the consistent performance of investment factors across the economic cycle.

For instance, equities have higher risk-adjusted returns in environments with rising growth, increasing yields and low volatility. Bonds have risk-adjusted solid returns in low inflation, decreasing interest rates and low volatility environments. Commodities delivered the highest Sharpe ratios in inflationary and accelerating economies. Value, momentum, carry, and low volatility across asset classes show a relatively stable pattern of risk-adjusted returns across all macro environments, suggesting that they are less sensitive to various phases of the macroeconomic cycle.

Chart 3: Asset classes and factors across economic cycles.[1]

[1] Source: Francesco Mandalà (2020), SFI Master Class "Factor-based Asset Allocation", Antti Illmanen AQR, Chicago Federal Reserve, Bloomberg.

The key insight of our research is that combining top-down macro views and bottom-up factor selection enhances long-term expected returns of our clients' portfolios. This approach provides a more effective diversification of portfolios across a broad range of economic factors.

Global Investment Opportunities (GIO) Mandates

The GIO mandates are actively managed multi-asset portfolios built around the principles of equal risk weighting and 'no home bias'. We follow a risk-parity approach, reduce the portfolios' equity beta, and increase the risk of alternative factors and commodities. The problem with the traditional construction of popular mandates, often built around a Strategic Asset Allocation (SAA) of 60% equity and 40% bond, is the dominance of the return profile by the volatility of the portfolio's equity component. By diversifying risks across asset classes and factors, we mitigate the equity concentration risk, lower the equity correlation between equity exposure and economic cycle, and allow more precise measurement and management of the risks in the portfolios. The GIO's objective is to achieve a compelling return with a risk target tailored to the client's risk tolerance. As a measure of risk, we use the historical standard deviation (volatility) of the mandates. We aim to target a low level of volatility for conservative mandates, a medium level for balanced mandates, and a relatively higher level of volatility for dynamic mandates, respectively. Further to our innovative portfolio construction methodology, we believe that investors are better off by investing in a globally diversified portfolio rather than holding a disproportionate share of domestic assets in their portfolio, i.e. following the popular “home bias” advice. Chart 4 shows the core ideas of our investment approach as implemented in the GIO portfolios offered to our clients. The GIO mandate is available in three currencies (Swiss Franc, Euro and US Dollar) and three strategies: Conservative, Balanced and Dynamic. The differentiating characteristic among the three risk profiles is the portion of cash-equivalent securities in each portfolio. For the rest, the portfolio allocations are the same across the three currencies as we hedge the currency exposure at the portfolio level.

Chart 4: Global Investment Opportunities (GIO).

Our GIO mandates combine asset classes and factors across all world regions (see Chart 5), according to the macro and market views of the Investment Committee (IC). As our risk factor-based approach requires a forward-looking macroeconomic view on monetary policy, geopolitical developments, inflation, interest rates, currencies and economic trends, the IC regularly assesses the market and macro conditions and translates its views into portfolio trades.

Chart 5: GIO diversification across asset classes and factors.

We also established a proprietary fund selection process blending qualitative and quantitative analysis of active funds and ETFs, as shown in the Chart 6.

Chart 6: Active funds and ETFs selection process.

We start from the definition of the managers' universe taking into account the IC's strategic or tactical views, the use of the mutual funds or ETFs in discretionary or advisory portfolios and the specific investment style, which reflects portfolio construction considerations, and, crucially, fees and costs. As a second step, we create a short list based on track-record, fund size, quantitative indicators and performance attribution.

Finally, we select the manager taking into account risks and the expected distribution of the fund's returns based on team, philosophy, investment process and current portfolio. Crucially, we believe that economic forecasts help forecasting investment factors performance, which can be used to predict mutual funds’ outperformance, so we sue the economic cycle for factor timing.